At the end of last year, Booz & Co released a report revealing CEO turnover in Australia was well above the global average for the 2011 year. This is a trend that appears to have continued with a surge of CEO renewals including BHP, Rio Tinto, Mirvac, Stockland and more. What has this meant for remuneration? Egan Associates examined remuneration for top 200 CEOs who started on 1 July 2011 or afterwards, comparing them with their predecessors.

Anecdotally, we hear that when CEOs leave, Boards seek to replace them at a lower rate given the recent focus on moderation in executive remuneration. After reviewing the data, Egan Associates found this holds, as can be seen in the graph below. It displays Total Employment Cost (fixed remuneration including base, fringe benefit tax, superannuation and non deductible costs) for new CEOs and former CEOs. The CEOs who left were paid at a premium to their replacements.

Internal versus External Hires

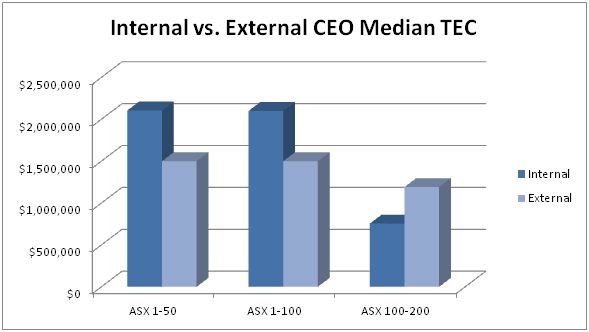

We also examined how likely it is for companies to hire internal successors rather than recruit external candidates. Of the 39 new CEOs in our sample, 22 were internally sourced and 17 were externally sourced. External appointments have not been paid a premium for the top 100 Australian organisations; internally sourced CEOs were paid more. Egan Associates notes that internal successors are often groomed to take the top job and are cognisant of the level of their predecessor’s pay, which can make reducing the size of CEO reward a more difficult proposition.

The External CEO appointees have a higher reward in the ASX 100 to 200 for our sample than the internal appointees. However, it’s important to state that the sample size here is not large and the internal appointments sample is over 60% Materials and Energy companies, which often remunerate their executives with potentially attractive performance share or option awards instead of providing high fixed remuneration.